Table of contents

ESG reporting is a type of corporate disclosure that details the environmental, social, and governance (ESG) promises, efforts, and progress of an organization. Sometimes referred to as sustainability reporting, it is not only a way to communicate your sustainability performance to your stakeholders, but also a strategic tool to create value for your business. According to a report by McKinsey, ESG reporting is becoming a global norm, with over 90% of S&P 500 companies publishing ESG reports in 2021.

Benefits of ESG Reporting

Why should you care? Here are some of the benefits that it can bring to your business:

- Enhance your reputation and public image. Reporting can help you showcase your positive impact on the environment, society, and governance, and demonstrate your commitment to ethical and responsible business practices. This can boost your brand loyalty, customer satisfaction, and employee engagement.

- Attract and retain investors. Disclosure of your material ESG risks and opportunities, and how you manage them can be more valuable with ESG reporting. This can increase your transparency and credibility with investors, who are increasingly looking for companies that align with their sustainable investing values and expectations. Not only that, but it can also help you access new sources of capital, such as green bonds, social bonds, and sustainability-linked loans.

- Reduce risks and improve performance. Identifying and addressing your environmental and social impacts, such as greenhouse gas emissions, waste management, human rights, and diversity is easier by reporting performance. This can help you mitigate potential legal, regulatory, reputational, and operational risks, as well as improve your efficiency, innovation, and resilience.

What are the Components?

ESG reporting covers three main aspects of your business: environment, social, and governance. Each aspect has its own indicators that measure your performance and impact on various issues. Here are some examples of common ESG indicators for each aspect:

Environment: This aspect covers your business’s environmental impact, such as climate change, biodiversity, water use, waste management, and carbon emissions. Some examples of environmental indicators are greenhouse gas emissions (GHG), energy consumption, renewable energy share, water withdrawal, waste generation, and recycling rate.

Social: This aspect covers how your business affects society, such as human rights, labor practices, health and safety, diversity and inclusion, community engagement, and customer satisfaction. Some examples of social responsibility indicators are employee turnover, gender pay gap, training hours per employee, injury rate, customer complaints, and social investment.

Governance: This aspect covers how your business is governed, such as board composition, executive compensation, business ethics, anti-corruption policies, risk management, and stakeholder engagement. Some examples of corporate governance indicators are board diversity, CEO pay ratio, and code of conduct compliance rate.

What are the challenges and opportunities of ESG reporting?

Challenges

Reporting for ESG is not without its challenges. Some of the common challenges that businesses face are:

- Data collection and verification. This type of reporting requires collecting and verifying data from various sources, such as internal systems, external providers, surveys, and audits. This can be time-consuming, costly, and complex, especially for businesses that operate in multiple locations and sectors and with a complex supply chain when wanting to report on supplier ESG performance. Data quality and consistency are also crucial for ensuring the reliability and comparability of ESG reports.

- Integration and alignment. Integrating and aligning ESG information with financial information, as well as with other reporting frameworks and standards is a requirement. This can be challenging, as different frameworks and standards may have different definitions, scopes, and requirements for ESG reporting. For example, some frameworks and standards focus on specific aspects or issues of ESG, such as climate change or human rights, while others provide a more comprehensive approach.

- Communication and engagement. This requires communicating and engaging with various stakeholders, such as investors, customers, employees, regulators, and civil society. This can be difficult, as different stakeholders may have different expectations and preferences for ESG reporting. For example, some stakeholders may want more detailed and quantitative information, while others may want more concise and qualitative information.

Opportunities

However, these challenges also present opportunities for businesses to improve their ESG reporting practices and outcomes. Some of the opportunities that ESG reporting can offer are:

- Data-driven decision making. ESG reporting can help businesses use data to inform their strategic decisions and actions on ESG issues. This can help businesses identify and prioritize their material ESG risks and opportunities, set targets and KPIs, monitor progress and performance, set benchmarks, and evaluate impact and value creation.

- Frameworks and standards adoption. ESG reporting can help businesses adopt and follow recognized frameworks and standards for ESG reporting. This can help businesses enhance the credibility and comparability of their ESG reports, as well as comply with regulatory requirements and stakeholder expectations. Some of the widely used frameworks and reporting standards for ESG are the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-related Financial Disclosures (TCFD), and the International Integrated Reporting Council (IIRC).

- Stakeholder relationships building. ESG reporting can help businesses build trust and transparency with their stakeholders through effective communication and engagement. This can help businesses understand their stakeholders’ needs and interests, respond to their feedback and concerns, demonstrate their accountability and responsibility, and create shared value.

How Accenture Integrated ESG and Financial Reporting

One of the best practices for ESG reporting is to integrate it with your financial reporting. This way, you can show how your ESG performance is connected to your business strategy and value creation. You can also demonstrate your accountability and transparency to your stakeholders.

A great example of integrated ESG and financial reporting is Accenture, a global professional services company. Accenture launched its 360° Value Reporting Experience in 2021, which brings together all its ESG and financial metrics, progress, and performance in one place.

How did Accenture achieve this? It used a cross-functional team and ecosystem partners to create a comprehensive and transparent reporting experience. It also leveraged technology and data to measure and communicate its ESG impact across multiple dimensions of value.

The 360° Value Reporting Experience showcases how Accenture delivers value to its clients, people, shareholders, partners, and communities. It also aligns with its business strategy and stakeholder expectations. By integrating ESG and financial reporting, Accenture demonstrates its commitment to sustainability and stakeholder capitalism.

You can learn more about Accenture’s 360° Value Reporting Experience here.

Best Practices and Tips

ESG reporting is not a one-size-fits-all process. Each business has its own context, goals, and challenges. However, there are some general best practices and tips that can help you improve your reporting process and quality. Here are some of them:

Identify your material issues

ESG reporting should focus on the issues that are most relevant and significant for your business and your stakeholders. You can use a materiality assessment to identify and prioritize your ESG metrics, based on their impact on your business and society, and their influence on your stakeholders’ decisions and expectations. Tools like our free-to-download ESG compliance checklist is a great way to quickly get started identifying material issues.

30+ Audit and inspection checklists free for download.

Set your targets and KPIs

ESG reporting should include clear and measurable targets and KPIs for your material issues, as well as your progress and performance against them. You can use SMART criteria (specific, measurable, achievable, relevant, and time-bound) to set your targets and KPIs, and align them with your business strategy and objectives, as well as with the global sustainability agenda.

Seek assurance

ESG reporting should be verified by an independent third party to ensure its accuracy, reliability, and credibility. You can seek assurance from external providers, such as auditors, consultants, or rating agencies, who can review your ESG data, processes, and reports, and provide assurance opinions or statements. Assurance can also help you identify gaps and areas for improvement in your sustainable reporting practices.

Engage stakeholders

ESG reporting should be a collaborative and interactive process that involves your stakeholders throughout the reporting cycle. You can engage your stakeholders by conducting surveys, interviews, workshops, or webinars, to solicit their input, feedback, and expectations on your ESG issues, targets, performance, and reports. Stakeholder engagement can also help you build trust.

Report on your impact and value creation

ESG reporting should not only report on your inputs and outputs but also on your outcomes and impacts. Consider reporting on how your ESG activities and performance contribute to creating value for your business and your stakeholders, as well as to achieving global sustainability goals. You should also generate annual reports on the positive and negative impacts of your business on the environment, society, and governance, and how you manage and mitigate them. You can use impact measurement and valuation methods such as ESG score to quantify and monetize your impacts and value creation.

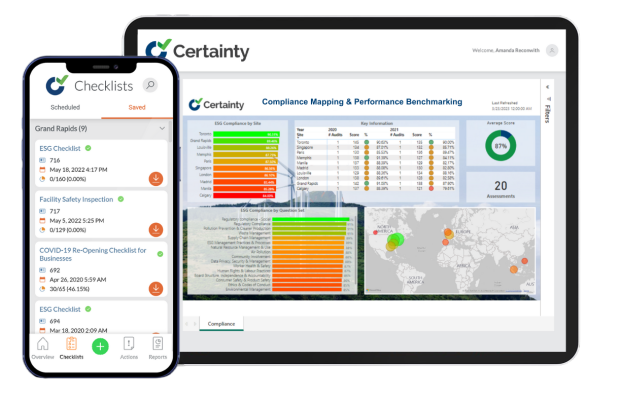

How to get started with ESG reporting with Certainty

ESG reporting can be a challenging and complex task for many businesses, especially for those who are new to it or have limited resources and expertise in ESG frameworks. That’s why having a reliable ESG assessment software solution that can help you simplify and streamline your reporting process and quality can make a big difference.

Certainty is a cloud-based software solution that enables businesses to collect, manage and report on their ESG data and performance. With Certainty, you can:

- Collect ESG data from various sources, such as internal systems, external providers, surveys, and audits, using customizable forms and templates.

- Manage ESG data in a centralized and secure database, where you can store, organize, validate, and analyze your ESG data.

- Report performance on ESG factors using interactive dashboards and reports, where you can visualize, compare and share your ESG data and insights.

- Follow frameworks and standards for ESG, such as GRI, SASB, TCFD, and IIRC, using pre-built or custom indicators and metrics.

- Seek assurance for your ESG reports, using built-in audit trails and verification features.

- Engage stakeholders in your ESG reporting process, using collaboration and communication tools.

Certainty is designed to help you make your ESG reporting more effective, efficient, and impactful for your business and your stakeholders. Whether you are a small or large business, whether you are a beginner or an expert, Certainty can help you achieve your ESG strategy goals.

If you want to learn more about how Certainty can help you with ESG reporting, you can sign up for a quick demo.

You might also be interested in: