Table of contents

Why You Should Care About Bill S-211

Forced labour and child labour are serious human rights violations that affect millions of people around the world. They also pose significant legal, ethical, and reputational risks for businesses that operate or source goods from global supply chains.

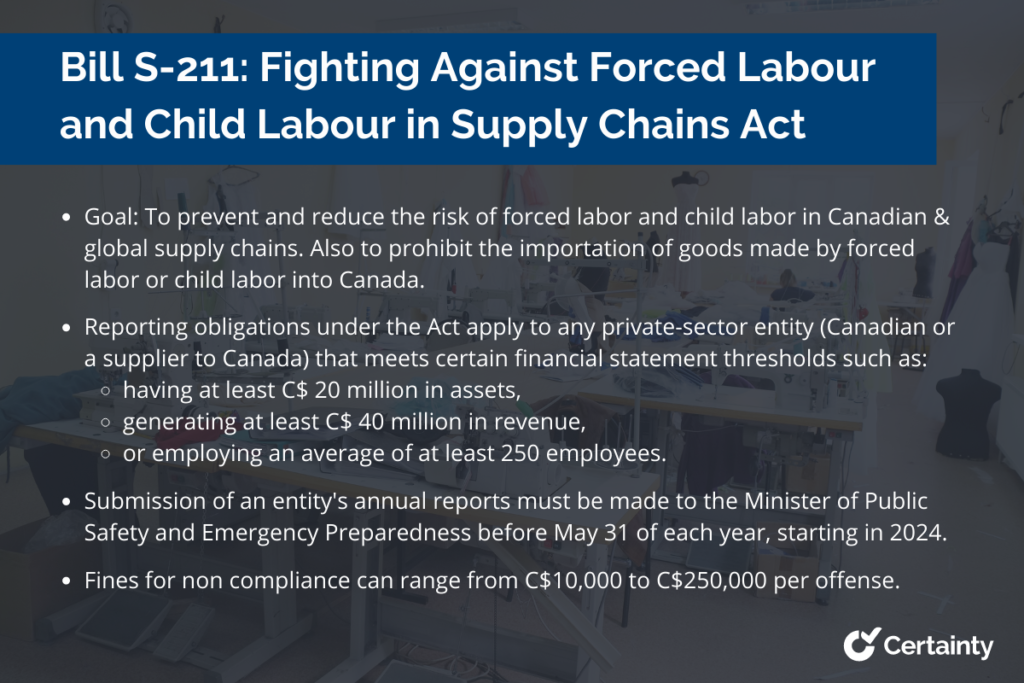

To address this problem, Canada has recently passed Bill S-211 to enact the Fighting Against Forced Labour and Child Labour in Supply Chains Act and to amend the Customs Tariff (the Act). Bill S-211 aims to increase transparency and accountability in supply chains by requiring government institutions and certain private entities to publish annual reports on their efforts to prevent and reduce the risk of forced labor and child labor in their supply chains. Also, it prohibits the importation of goods made by forced labor or child labor into Canada.

In this blog post, you will learn how Bill S-211 could affect your business and your supply chain management. You will also find out how to manage your supply chain risks and reporting obligations effectively.

What You Need to Know About the Reporting Obligations

The reporting obligations under the Act apply to any private-sector entity that meets certain thresholds. Based on its consolidated financial statements, these thresholds could include:

- having at least C$ 20 million in assets,

- generating at least C$ 40 million in revenue,

- or employing an average of at least 250 employees.

These obligations also apply to all federal government institutions, ministries, and departments, including Crown corporations and wholly owned subsidiaries.

Submission of an entity’s annual reports must be made to the Minister of Public Safety and Emergency Preparedness before May 31 of each year, starting in 2024. The reports must disclose information such as:

- Policies, procedures, due diligence measures, training programs, and remediation actions that the entity has implemented or plans to implement to prevent. Specifically on reducing the risk of forced labour and child labour in its supply chain.

- The structure of its supply chain and the countries where its goods are produced or sourced. For Canadian and global enterprise-level businesses, this can be challenging to identify its tier 1, 2, and 3 suppliers. To accomplish this, businesses will need optimal supply chain visibility. Check out our blog post on supply chain visibility to learn how to get started.

- Any instances of forced labour or child labour that it has identified or been made aware of in its supply chain.

- Any challenges or difficulties that it has encountered or anticipates encountering in complying with Bill S-211.

The report must be made available to the public in a prominent place. This could include being on the entity’s website or on a website designated by the Minister.

What You Need to Know About the Fines

Bill S-211 also establishes a system of fines for private entities that make false or misleading statements in their reports or that fail to comply with the reporting obligations. Ultimately, fines can range from C$10,000 to C$250,000 per offense. However, this depends on the nature and severity of the violation.

The fines under the Act could affect your business in several ways, such as:

- Imposing financial costs, legal liabilities, and public scrutiny on your business

- Motivating you to improve your supply chain performance and compliance with the law

- Encouraging you to cooperate with the Minister and other authorities in resolving any issues or disputes

What You Need to Know About the Customs Tariff

The Act also amends the Customs Tariff to prohibit the importation of goods into Canada that are made in whole or in part by forced labour or child labour. The prohibition applies regardless of whether the goods are for consumption or use in Canada or for exportation to another country. This also applies regardless of whether the importer knew or should have known that the goods were made by forced labour or child labour.

The prohibition under Bill S-211 could affect your business in several ways, such as:

- Affecting the availability and cost of goods in Canada that are sourced from countries where forced labour or child labour is prevalent

- Requiring you to source or produce goods that comply with the law and to track and verify the origin and production methods of the goods you import or export

- Encouraging you to adopt ethical and sustainable sourcing practices and to engage with your suppliers and stakeholders on human rights issues

What You Need to Know If You Supply Goods to Canada

If you are a foreign business that supplies goods to Canada, you should also be aware of how Bill S-211 could affect not only your performance but also your own suppliers. The Act could have implications for your business in several ways, such as:

- Require you to comply with the reporting obligations under the Act if you meet the criteria (Part 2 Section 9) of a private entity that produces or imports goods into Canada or that controls an entity that does so. This means you would have to submit an annual report to the Minister and make it public on your website or on a website designated by the Minister.

- Ensure that the goods you supply to Canada are not made by forced labour or child labour, as they could be prohibited under the Customs Tariff and seized by the Canada Border Services Agency. This could affect the availability and cost of your goods in Canada and expose you to legal liabilities and reputational damages.

- Monitor and verify the compliance of your own suppliers with the Act and with international standards and guidelines on human rights and supply chain due diligence. This could include conducting audits and assessments, implementing policies and procedures, providing training and education, and implementing remediation actions and corrective measures.

30+ Audit and inspection checklists free for download.

How to Manage Your Supply Chain Risks and Reporting Obligations Effectively

As you can see, Bill S-211 could have a significant impact on your business and your supply chain management. To prepare for the new law and to manage your supply chain risks and reporting obligations effectively, you should consider the following tips or best practices:

- Conduct regular audits and assessments of your supply chain to identify and address any risks or issues related to forced labour or child labour

- Implement policies and procedures that align with international standards and guidelines on human rights and supply chain due diligence, such as the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises

- Provide training and education to your employees, suppliers, and partners on the requirements and expectations of the Act and on how to prevent and reduce the risk of forced labour or child labour in your supply chain

- Implement remediation actions and corrective measures to address any instances of forced labour or child labour that you find or are made aware of in your supply chain

- Engage with your suppliers and stakeholders on a regular basis to monitor their compliance with the Act and to foster trust and collaboration on human rights issues

- Use Certainty Software, a leading supply chain management software solution, to help you streamline your data collection, analysis, and reporting processes.

If you want to learn more about how Certainty Software can help you comply with Bill S-211 and improve your supply chain management, please contact us today for a free demo or consultation.

You may also be interested in: