Table of contents

The process of auditing involves confirming and assessing the performance, quality, and compliance of an organization. Businesses can use it to find and fix any mistakes, frauds, or operational inefficiencies they may have. Other stakeholders, including shareholders, creditors, consumers, suppliers, and regulators, might benefit from audits by learning important information.

However, there are other audit kinds, each of which has its own needs and functions. In this blog post, we will define first-party, second-party, and third-party audits, describe their differences, and discuss their significance for your company.

What is a First-party Audit?

Of the three types of audits, a first-party audit has the most internal control. First-party audits, also known as internal audits, are performed using a business’s own audit resources and audit processes.

A first-party audit is used as a risk management tool to ensure that a business’s own internal systems, workflows, and procedures meet its specified requirements. If they don’t, corrective action is taken. Commonly, they are effective at measuring areas of an organization such as its quality management system (qms).

In first-party audits, the internal auditors are employed by the company and have direct knowledge of the systems being audited. We recommend selecting an impartial audit team to avoid any bias in the results. It is also recommended that internal audits be performed on an annual basis – but this can vary based on specific projects, processes, systems, etc.

What is a Second-party Audit?

An external audit of a supplier conducted by a customer or a hired company on the customer’s behalf is known as a second-party audit. This type of audit makes sure that suppliers meet contractual obligations, and helps make decisions about contracts.

Second-party audits help ensure that businesses’ suppliers are meeting quality, environmental, and safety requirements set by their customers. This helps manage risk for the business.

Second-party audits can be conducted either on-site by examining the procedures, or off-site by reviewing the supplier’s documentation such as financial statements.

What is a Third-party Audit?

A third-party audit is conducted by an audit organization that is impartial and independent of the supplier-customer relationship. These certifying bodies help confirm that organizations comply with regulations or standards, and are free of any conflicts of interest.

A third-party organization or an interested party might issue a certification, registration, recognition, award, licensing approval, or penalty as a result of a third-party audit.

We recommend that your company regularly schedules its internal audits, in addition to third-party audits. During this internal check-in for compliance, you can identify faults before discoveries are made by external auditors.

30+ Audit and inspection checklists free for download.

Comparison of Audit Types

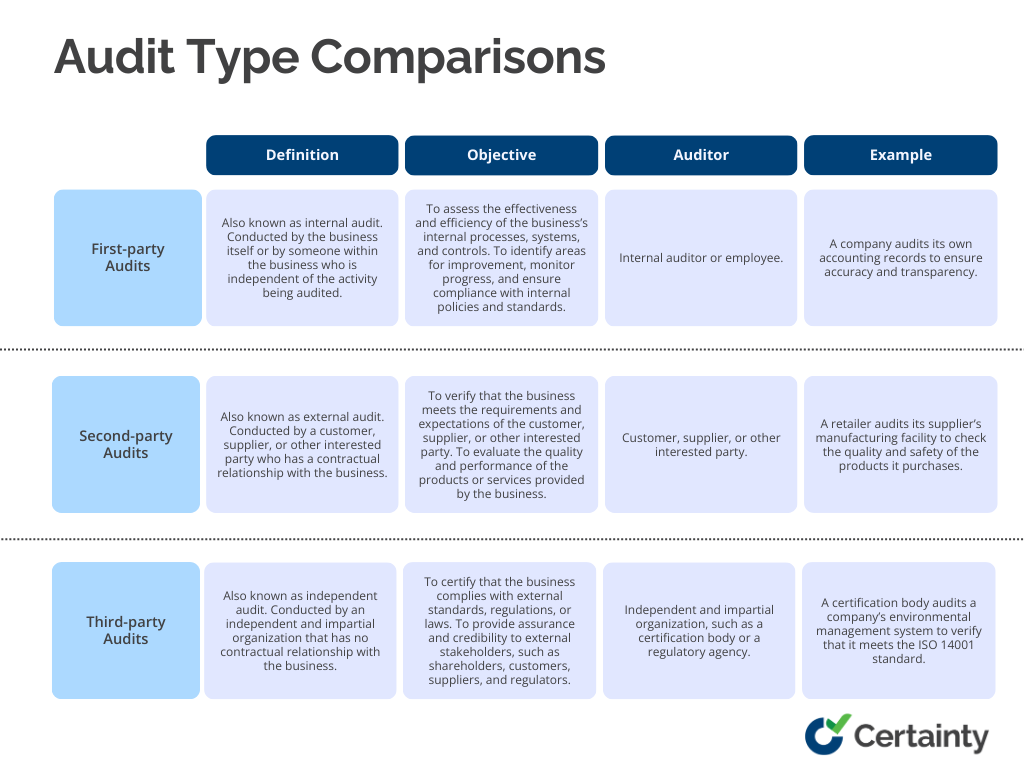

You now understand the differences between first-party, second-party, and third-party audits and how each one can benefit your company. But how do they contrast and compare to one another? What are their shared and unique characteristics?

Each audit type has a unique description, objective, auditor, and example, as you can see from the table above. They do, however, also have some variances and commonalities.

Some of the similarities are:

- The planning, carrying out, reporting, and following up on the audit results are similar for all types of audits.

- All audit types seek to raise the level of compliance, quality, and performance inside the company.

- All audit categories need to provide conclusions and suggestions that are supported by data.

Some of the differences are:

- Comparatively speaking, first-party audits are more adaptable and informal than second and third-party audits.

- Compared to first-party and third-party audits, second-party audits are more subjective and prejudiced.

- In comparison to first-party and second-party audits, third-party audits are more thorough and reliable.

How to Select the Right Audit Type

Choosing the right audit type for your company depends on several factors, such as your business objectives, risks, stakeholders, and resources. Here are some questions you can ask yourself to help you decide:

Consider Your Objectives

What are the audit’s primary objectives and advantages? Do you wish to strengthen internal procedures, check your compliance with agreements, or get external certification?

- A first-party audit can be the ideal option for you if you wish to enhance your internal procedures. You can use it to evaluate your strengths and weaknesses and pinpoint your areas for development.

- A second-party audit can be the ideal option for you if you wish to confirm your contractual commitments.It can assist you in making sure you satisfy the demands and expectations of your clients, vendors, or other interested parties.

- A third-party audit can be the most effective option for you if you wish to gain external accreditation. It can assist you in proving that you abide by outside standards, laws, or regulations and provide your stakeholders confidence and credibility.

Assess Risks and Difficulties

What are the audit’s primary risks and difficulties? Do you have any performance gaps, quality difficulties, or compliance problems?

- An audit by a third party can be the best option for you if you have any compliance problems. It may assist you in avoiding any sanctions, fees, or legal actions that could follow non-compliance.

- A second-party audit can be the best option for you if you have any quality issues. It can assist you in raising client happiness and loyalty while enhancing the quality and effectiveness of your goods and services.

- The best audit for you might be a first-party audit if you have any performance gaps. It can assist you in setting attainable, measurable goals and tracking your advancement.

Identify Primary Stakeholders

Who are the audit’s primary stakeholders? Do you have to appease your own management, clients, vendors, or outside regulators?

- The best audit for you might be a first-party audit if you need to satisfy your own management. It can assist you in telling your management about your findings and suggestions so that you can win their support and endorsement.

- A second-party audit can be the finest option for you if you need to satisfy your consumers. You may improve your reputation and brand image while also gaining your client’s trust and confidence.

- The ideal option for you may be a second-party audit if you need to satisfy your suppliers. It can aid in the development and upkeep of positive relationships with your providers and guarantee their dependability and quality.

- A third-party audit can be the best option for you if you need to satisfy external regulators. It can assist you in abiding by company policies so that you can avoid penalties or restrictions.

Assess Resources and Expenses

What are the audit’s primary resources and expenses? Do you have an adequate number of independent, external, or internal auditors? How much work, money, and time will be needed for the audit?

- The ideal audit for you might be a first-party audit if you have adequate internal auditors. Utilizing your own resources and knowledge can help you save time, money, and effort.

- The best option for you may be a second-party audit if you have enough external auditors. It can assist you in utilizing the assets and knowledge of your clients, suppliers, or other relevant parties.

- The best option for you may be a third-party audit if you have enough impartial auditors. It can assist you in gaining access to the resources and knowledge of a neutral, impartial body that is not bound by a contract to your company.

Improving First-party Audits

Internal audits are vital for businesses to maintain compliance with regulatory standards. They’re also excellent for self-reflecting on how well your company meets its own internal standards, processes, and overall goals.

Whether managing a single location, or multi-site operations, Certainty Software supports your efforts to streamline every step of first-party audits by making them centralized and more manageable. With many multilingual features that include customizable forms, configurable checklist workflows, enterprise-wide reporting, and corrective action delegation, you’ll successfully unlock the full potential of first-party auditing.

You may also be interested in: