What is Environment, Social, Governance – ESG?

Environment, social, governance (ESG) is the measurement of the impact (both positive and negative) that a business has on the environment and on society including an assessment of the governance practices (or lack thereof) that impact all stakeholders – including shareholders.

Investing (by individuals, asset managers, pension fund managers, etc.) in businesses that embrace ESG is often referred to as sustainable investing, responsible investing, impact investing, or socially responsible investing (SRI).

First coined in 2004, in the landmark report Who Cares Wins, (a collaboration of the UN Global Compact, the International Finance Corporation, and the Swiss Government), ESG embeds financial and non-financial environmental, social, and governance factors into corporate reporting. Initially used to aid investment decision-making, ESG now increasingly influences the decision-making of employees, customers, and communities.

The foundation of best practice ESG reporting is an assessment of ESG performance against environmental, social, and governance criteria – essentially an ‘ESG SWOT analysis’. An ESG performance assessment identifies ESG risks and opportunities. Improved ESG performance is achieved by establishing good corporate governance practices that effectively identify, manage, and mitigate the social and environmental risks of a business.

At its very core, ESG is a tool to measure – or attempt to measure – the sustainability of (and thus long-term return on investment in) a business. Improved ESG performance makes a business more sustainable, strengthens wider capital markets, and leads to better outcomes for society and the environments on which we depend.

How is ESG Performance Assessed?

Presently, there isn’t a globally accepted standard, assessment methodology, or checklist to measure the ESG performance of a business. In practice, however, all ESG performance assessments attempt to measure the impact a business (its products and services) has on the environment and society including an assessment of how well a business is governed to manage those impacts.

Environment

Environment assesses the impact a business has on the natural environment and should include the impact of the production, use, transportation, and disposal of a business’s products or services. Environment should include an assessment of:

- natural resources sourcing, use, management, and conservation

- impact on biodiversity and the treatment of animals

- air pollution – especially greenhouse gas (GHG) emissions and carbon footprint

- waste management and discharges to land and water

- the use of toxic chemicals and the management of hazardous waste

- energy use and conservation

- environmental risks and how well those risks are managed (contaminated land, natural disasters, climate change, etc.)

- compliance with environmental regulations

Social

Social assesses the impact a business has on society and the relationships it has with its stakeholders including employees, consumers, suppliers, and the communities in which they operate. Social will similarly include the societal impacts associated with the full life cycle of a business’s product or service delivery. Social should include an assessment of:

- respect for and observance of human rights

- working conditions and fair labor practices – including those of suppliers and the supply chain

- hiring practices, employee engagement, equal opportunity, gender, diversity, and inclusion

- occupational health and safety management

- community relations, initiatives, and engagement

- customer satisfaction

- social risks and how well they are managed

- social license to operate (SLO) and meeting the expectations placed on a business for societal acceptance

Governance

Governance assesses how well a business is governed, the composition and transparency of its Board of Directors, and the degree to which governance practices identify, manage, and mitigate the environmental and social impacts of a business. Governance should include an assessment of:

- board structure, diversity, and independence

- executive selection (including conflict of interest), committees, and compensation

- board transparency and shareholder rights

- board understanding of and commitment to ESG

- corporate codes of conduct, business ethics, and values (including bribery, fraud, and corruption)

- lobbying and political contributions

- data protection, privacy, and security

- corporate risk management and how well risks are managed (actual and potential lawsuits, supply chain interruptions, natural disasters, regulatory change, loss of reputation and brand value)

- compliance with financial regulations, accounting standards, and disclosure requirements

Why is ESG Important for Companies and Their Boards?

Improved Access to Capital

ESG is the product of the 2004 collaborative initiative between the UN Global Compact and CEO’s of more than 20 major financial institutions with assets under management (AUM) of over USD $6 trillion. The initiative establishes that integrating environmental, social, and governance issues into investment decision-making, and thus capital markets, reduces business risk, improves long-term corporate performance, strengthens financial markets, and delivers more sustainable outcomes for society.

The genesis of ESG was capital and access to it. Since its inception in 2004, ‘ESG’ assets under management (AUM) have grown steadily. Between 2016 and 2021 ESG alone, and AUM grew at 30% per year. In 2021, ESG AUM was $37.8 trillion and ’are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion’

Businesses with better ESG performance tend to be more sustainable, provide better long-term returns to investors, and will have greater access to the ever-growing pools of ESG capital. Conversely, businesses with poor ESG performance – or those that do not embed ESG factors into corporate performance reporting – will increasingly be seen as riskier, less sustainable, and will be less able to access capital.

Improved Risk Management

As the world around us changes, environmental and social factors increasingly and irreversibly impact our lives. The externalities of businesses (environmental and societal impacts of a product or service not included in – or external to – the cost associated with the production, use, or disposal of that product or service) are increasingly being seen for what they truly are which is a risk to the sustainability of a business.

In practice, therefore, ESG is the assessment of a company’s risk, externalities, and management activities in relation to all its stakeholders: workers, communities, customers, shareholders, and the environment. It is the new lens by which investors, employees, and society at large view the companies they invest in, work for, and buy from.

Businesses that incorporate ESG best practices into their governance, operations, mindset, and ethos will, by definition, be incorporating best practice risk management into their business.

Better Financial Performance

As concluded in the 2004 UN Global Compact report Who Cares Wins – ‘in a more globalized, interconnected and competitive world’, the improved management of environmental, social and corporate governance issues will ‘increase shareholder value’ and ‘have a strong impact on reputation and brands, an increasingly important part of company value’.

Since 2004, the value of ESG AUM funds has grown steadily. The proposition that improved ESG will improve corporate financial performance is increasingly being seen to be true in capital markets globally.

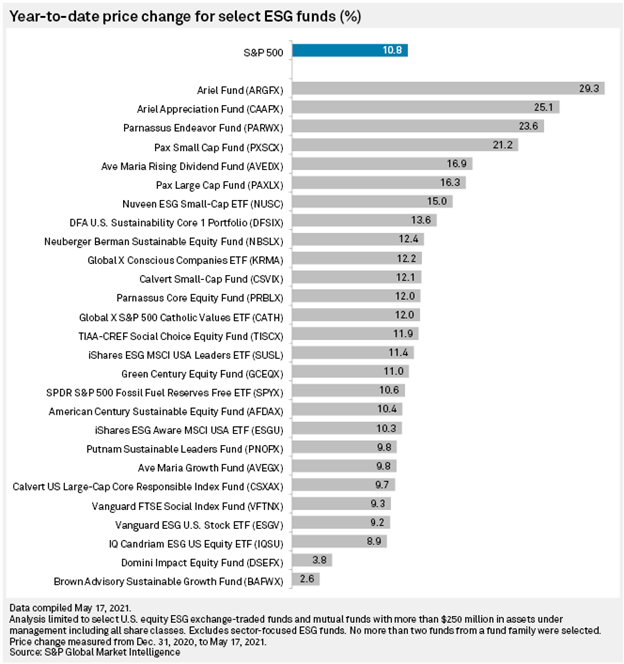

According to S&P Global Market Intelligence, ‘from Dec. 31, 2020, to May 17, 2021, 16 of 27 ESG exchange-traded funds and mutual funds tracked performed better than the S&P 500. Those outperformers rose between 11% and 29.3% over that period. In comparison, the S&P 500 increased 10.8%.’

By incorporating ESG thinking into governance and management, a business regularly and systematically assesses both financial and non-financial factors that could affect its long-term sustainability. ESG-led businesses thus have a wider, deeper, and longer-term view of the risks and opportunities that could impact their operations. They are better armed to identify risks sooner, manage them better and simultaneously recognize opportunities to take advantage of them. In our rapidly changing world, ESG provides a business with the framework for better risk management, improved social and environmental sustainability, and better overall financial performance.

Source: S&P Global Market Intelligence

Increasing Risk in Not Embracing ESG

The world around us is changing fast and so to is investors’ tolerance towards businesses with poor governance practices, and/or unsustainable environmental or social impacts. Today, corporate ESG leaders are enjoying access to, and inclusion in, an ever-increasing pool of ESG funds. Conversely, ESG laggards with poor ESG performance are being excluded from this growing volume of ESG funds, and some – in the case of companies associated with deforestation in Brazil – now face divestment from the portfolios of reputable asset management firms.

According to Reuters, in June 2020, seven major European asset management firms with over $5 billion linked to Brazil (Storebrand, AP7, KLP, DNB Asset Management, Robeco, Nordea Asset Management) indicated ‘they would divest from beef producers, grains traders and even government bonds in Brazil if they do not see progress in resolving the surging destruction of the Amazon rainforest’.

Businesses that ignore ESG do so at their peril as there are clear indications of significant and increasing financial risks in being an ESG laggard.

Ensures Compliance with Existing and Impending ESG Reporting Requirements

In 2014, the European Union enacted Directive 2014/95/EU better known as the Non-Financial Reporting Directive (NFRD). This directive, and thus EU law, requires ‘certain large companies to disclose information on the way they operate and manage social and environmental challenges.’ NFDR covers approximately 12,000 larger public companies and groups in the EU including listed companies; banks, insurance companies, and others designated as public-interest entities.

In 2019, the European Commission published the Sustainable Finance Disclosure Regulation. This regulation strengthened sustainability reporting and established sustainability disclosure obligations for manufacturers of financial products and for financial advisers toward end investors. In force from March 2021, the regulation aims to ‘integrate sustainability risks’ into investment decision-making and impacts financial market participants including asset managers, institutional investors, insurance companies, pension funds, and all entities offering financial products or advice in the EU.

30+ Audit and inspection checklists free for download.

In March 2021, the not-for-profit IFRS Foundation ‘announced the formation of a working group to accelerate convergence in global sustainability reporting standards’. This working group is comprised of the heavy weights of sustainability reporting and includes the International Accounting Standards Board (IASB), the Task Force on Climate related Financial Disclosures (TCFD), the Value Reporting Foundation, the International Integrated Reporting Council (IIRC), the Sustainability Accounting Standards Board (SASB), the Climate Disclosure Standards Board (CDSB) , the World Economic Forum (WEF), the Global Reporting Initiative (GRI) and the Carbon Disclosure Project (CDP). IFRS Accounting Standards are currently required in more than 140 jurisdictions and it is expected that this working group will develop global ‘standards for climate-related reporting and other sustainability topics’.

In April 2021, Gary Gensler was appointed by the Biden Administration as the chairman of the US Securities and Exchange Commission (SEC). Given his ‘aggressive enforcement track record’ at the Commodity Futures Trading Commission (CFTC), many observers – including the National Law Review – see it as ‘widely expected that the SEC will take up the issue of ESG reporting as it has in the past under the chairmanship of Democrats’.

In April 2021, the European Commission published the draft Corporate Sustainability Reporting Directive (CSRD) which is planned to come into force in 2023. The CSRD will replace the existing NFRD which according to the Business for Social Responsibility will better ‘provide investors with the information they need to consider ESG in their investment decisions’ and ‘will also enable civil society organizations, trade unions, and other stakeholders to assess companies’ impacts on society and the environment’. The CSRD will cover approximately 50,000 ‘large’ companies in the EU.

Like the growth of ESG AUM itself, the call for increased corporate transparency about ESG issues is growing steadily. While only a fraction of companies are presently required to report on ESG matters, it appears inevitable that listed companies the world over will face increasing pressure – and regulatory requirements – to include ESG performance reporting in their annual reports.

What is Best Practice ESG Reporting?

Just as there is no single standard assessment methodology for ESG performance, there is no single reporting format (yet) for ESG transparency and reporting either. There are, however, several reporting standards that, if used, will deliver what could be considered ‘best practice’ ESG reports. These standards are as follows:

The Global Reporting Initiative Universal Standards

Established in 2000, The Global Reporting Initiative (GRI) is an independent, international organization founded to help businesses (and other organizations) take responsibility for their social and environmental impacts. The GRI aims to provide ‘a global common reporting language’ to communicate those impacts. The GRI reporting standards are recognized as ‘the world’s most widely used standards for sustainability reporting’ and are comprised of 35 Universal Standards and the growing list (now 45) Sector Standards.

The Value Reporting Foundation, Integrated Reporting <IR> Framework, and SASB Standards

The Value Reporting Foundation is a global non-profit organization established to ‘help businesses and investors develop a shared understanding of enterprise value—how it is created, preserved and eroded’.

The Foundation has developed both the Integrated Reporting <IR> Framework which provides principles-based guidance for comprehensive corporate reporting and the 77 industry-specific SASB standards that address ‘sustainability-related risks and opportunities reasonably likely to affect an organization’s financial condition (i.e., its balance sheet), operating performance (i.e., its income statement), or risk profile (i.e. its market valuation and cost of capital)’.

With the growing importance of ESG reporting and the ever-increasing likelihood of an internationally recognized ESG reporting standard compatible and consistent with the existing GRI and VRF standards, businesses that want to better understand their ESG performance, prepare for future ESG reporting requirements and meet present best practice ESG reporting should at the very least consider the GRI and VFR standards and any of their relevant sector standards where they apply.

You may also be interested in:

How Certainty is used by businesses and their supply chains for ESG assessments